Subtraction Water/Wildfire

2014

Watch Video

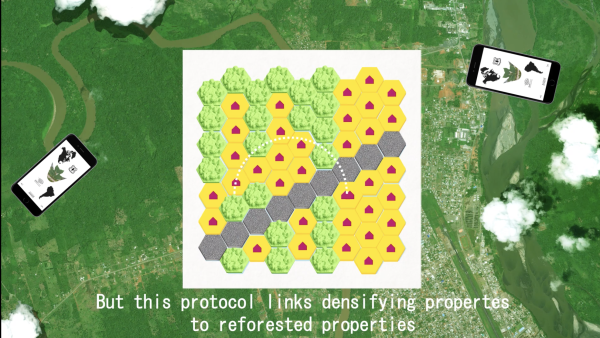

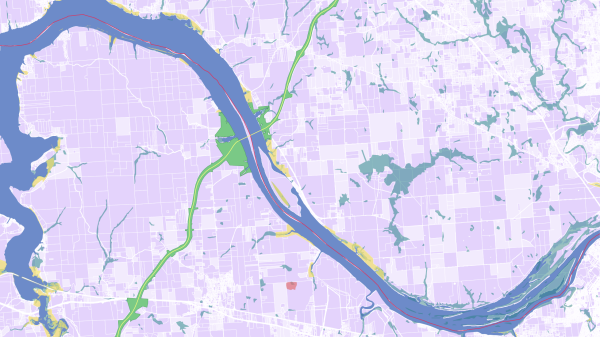

What if, rather than relying solely on generic econometrics, a parallel market of particular spatial variables could offer more tangible risks and rewards as well as the agility to avoid and recover from either natural or financial disaster?

Imagine an entrepreneurial effort to create a property exchange focused on an interplay between properties. An information-rich index with the benefit of intelligence from urbanists, landscape architects, and regional environmentalists could target and rate properties for their complementary risks and benefits or their counterbalancing attributes. In other words, like a matchmaking website, the exchange then rates not only properties themselves, but the benefits of changing use or swapping positions in the urban/regional landscape. It rates or certifies mortgage transactions that result in an advantageous relocation or consolidation of property with reduced collective risk for all. The more advantageous the swap, the higher the rating: a shoreline owner moves to higher ground; a year round coastal property becomes a seasonal vacation property; a municipality is able to aggregate land for levees, revetments, dunes, or sand replenishing programs; a clearing adds value to a denser property on its perimeter by providing views and water retention. In any of these transactions, since the trade itself is worth a quotient of flood insurance and since it becomes an increasingly viable mortgage, the exchange draws investment from insurance companies and banks. Both institutions also incentivize the transaction with lower rates and streamlined deals. In many cases, a simple rating that accounts for a number of factors would simplify mortgage and exchange transactions, stripping away many of the quantitative technical languages and replacing them with qualitative indicators. Deadlocked and devalued properties could then be revalued and released into circulation.