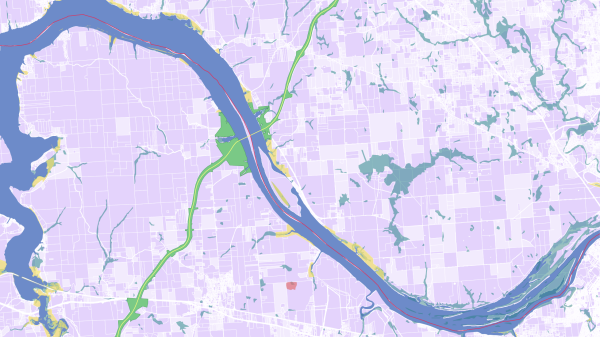

Stream

2010

An industry to extract or harvest construction materials juggles a complex cocktail of parameters including regulatory incentives, equipment, volume, reuse scenarios and transportation costs. One emergent phenomenon within material management systems

are special softwares that crunch numbers between these variables to discover opportune relationships within a market. For instance, in the UK, WRAP (Waste and Resources Action Program), is a non-profit group that works with the construction and demolition industry to develop markets for recycled products. They have developed and

provide a powerful online tool for calculating profitable recycling.

Similarly, in the US, the Environmental Protection Agency (EPA) has sponsored “decision support tools” to help waste managers test scenarios and determine new environmental economies. While these tools are aimed at the broad spectrum of solid waste, there is not currently a specific tool for construction and demolition waste. Amidst anecdotal state regulations, the EPA establishes no national waste regulation but rather offers encouragements or “challenges” to business to recycle a relatively low 35% of materials. The three largest

waste managers in the US have multi-billion dollar businesses and already have their own techniques for calculating waste generated revenue. The emerging trade industry, comprised of groups like the National Demolition Association (NDA) or the Construction

Material Recycling Association (CMRA), struggles to create salience and volume.

Rather than waiting on the possible successes of a web-based calculator or the glacial reforms typical of recycling regulation, a web-based marketplace like STREAM has ramifying and potentially more powerful consequences in the US scene where only a few waste companies have powerful monopolies that shape waste policy. A materials market place is not dissimilar to any of the other online markets that have changed the audience and venue for trading new and used goods. During the current financial crisis, many of the components of homes and workplaces have been traded in these markets. Portable fixtures, appliances, equipment, interior finishes, remaindered tools and materials—from floor boards to roof shingles—have been sold on Ebay.

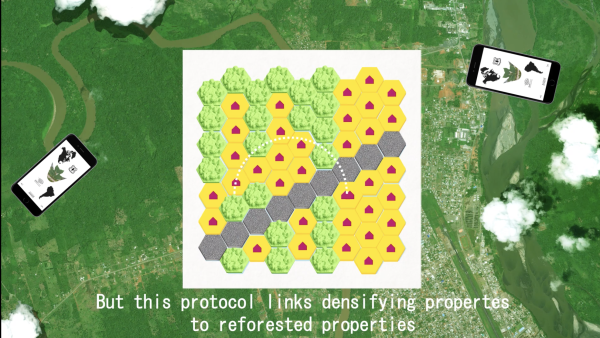

A materials market could extend to not only small lots of used surplus material but also to tonnage or volume of material removed in a building demolition. A very simple building material calculator/converter as a mobile app could allow users to post available materials and reference selected market values (e.g. dollars/tons of copper, local transportation costs/ton). It could provide a more agile source of information for the small and midsize operators. Operators would be able to increase their own volume and inventory by harvesting the materials from numerous construction projects. The seller, who used to pay a disposal fee for material previously known as waste, can either sell the material or trade its determined value for removal. Compounding volumes and opportunities potentially lends momentum to the waste industry. The project aspires to be but one

point of leverage in the emergent industry of building material reuse and recyling.

Graphics: Keller Easterling and Travis Eby