Subtraction Protocol 1 McMansion

2011

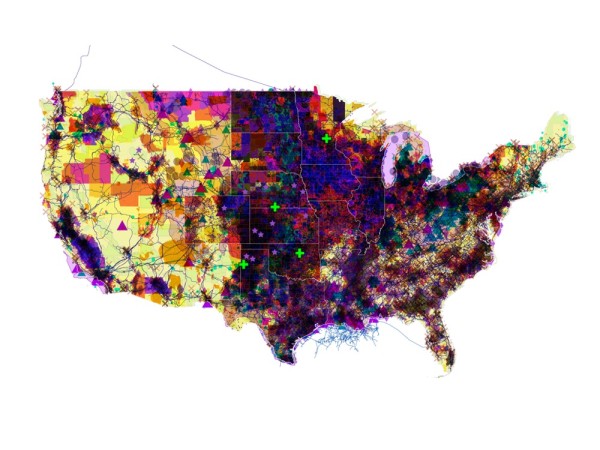

In a turnabout, what if the physical house was to become a more prominent and palpable asset than its attending financial constructs? If the era of architecture as a currency is over, then perhaps it is now possible for homeowners to trade in other values related to their home and neighborhood. A home could become a portfolio of assets that a homeowner or groups of homeowners control. These assets include its presence, capacity and location—measured in real estate transactions—as well as all its materials when disassembled: its energy producing capacity (wind, sun, geothermal), its biodiversity value, its carbon value, its cultural value and the shares it holds in related properties. In areas prone to erasure from floods or earthquakes, insurance risk is also part of that portfolio.

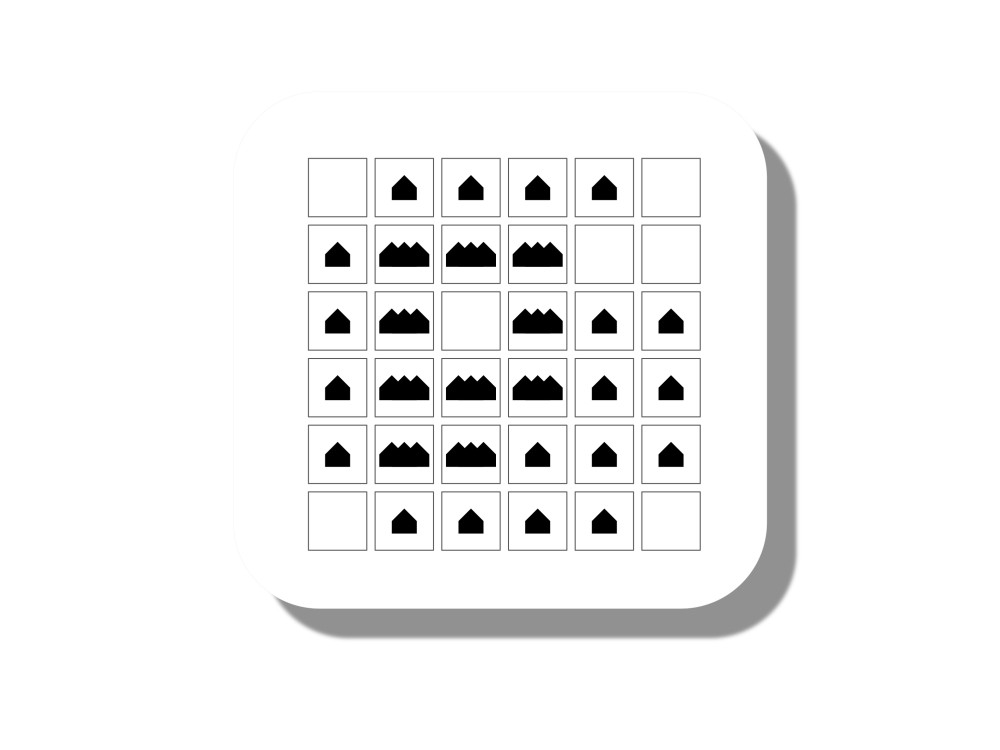

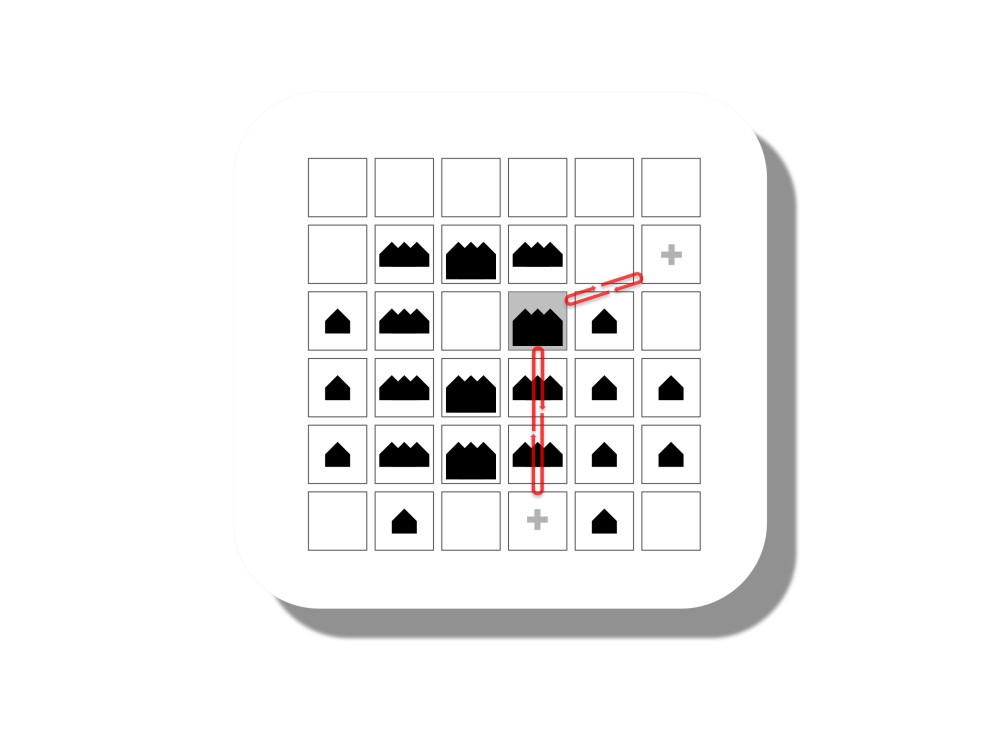

Consider the Savannah formula in reverse—where the thing created is not building but clearing. A governing interplay of spatial variables can be used to curb speculation and hedge against risk. In a twist on the usual notion of the home as autonomous entity, interdependencies would make the house both more stable and more financially independent. Also, while the wealthiest markets have well-rehearsed techniques for deleting the constructions of the disenfranchised; here the tables are turned, and distended populations of McMansions are the subject of deletion.

In an elementary ecology of properties, the game might play out through a number of simple moves. Densifying properties are linked to properties in places where development is being deleted. The increased tax revenues from one or the other sustain both, and relieve sites that are toxic or without value. Not only relieved of a toxic property, these owners now also have some share in their new partner space—a hedge space which may be remote or nearby.

As a reserve of value, the remote lots help overcome the normal obstacles to land acquisition. They ease the city’s start-up costs for innovations like solar, wind or rail that can be located on peripheral or even polluted sites. The owners of the densified lots that produce the increased tax revenues also become automatic shareholders in the new enterprises located on the remote sites. They too have an offset or a hedge against further real estate perils since they own not only interests in their own lot. Like a diversified portfolio, the game is filled with offsets and interdependencies. For banks, the protocol generates business and stabilizes loans previously in default. Revenues from the cleared space act as micro-dividends, strengthening densified areas while still remaining a safe percentage of the total worth of the property.

Not only in the overbuilt suburbs of the affluent, the protocol might be used in any location where development would be wise to retreat from exhausted land, flood plains or special land preserves. It might even be used in areas that are the target of slum clearance. A subtraction economy, offers developers and landowners somewhat less violent tools of acquisition with safeguards against disenfranchisement.